From the time we are young, society teaches us that when we grow up, we will need to find a job with which to earn money to pay our bills. For sure, money is necessary for survival in our society. And a job is one of the most common ways to accomplish this task in the short term. What society teaches us less often is that there are more ways to earn money than through a job. Indeed, there are some very good alternatives to holding a job to make a living.

Most people will necessarily hold a few jobs in their life time. This is because most people don’t have enough cash saved to meet their basic needs, especially when they first set out to make income via a job alternative. However, as you build up your financial cushion, setting out to make income via a job alternative becomes easier. Keep in mind however that pursuing income via these job alternatives is never an easy feat. These job alternatives are often long-term endeavors that require self-direction, discipline, constant learning, perseverance, and patience. Below are what I think are the best available alternatives to a job.

The Key to Job Alternatives: Passive Income

The key to being able to detach income from a job is to establish passive income streams. Passive income is when you earn money in a manner that is not directly tied to how much work you do, or when you do that work. With passive income streams, you do most of the work upfront. You do not need to invest much additional time or effort investment after putting in some initial work.

There are various types of methods to generate passive income. Some of these methods are more lucrative than others. You may choose to try one of these at a time. But ultimately it might be best to dab into various streams of passive income to diversify your income. After all, it is best to diversify your income so that if one income stream fails, you still have other streams of income.

A lot of people who are financially successful have developed multiple income streams over the long term. At first, these passive income streams may serve to supplement income. However, in the long run, they can derive enough income to serve as alternatives to a holding a job.

As you can imagine, these alternative ways of earning money can open eventually open up to more freedom and opportunities than if your only notion of making money was through a job. This is especially true since a job usually requires you to structure your life around your job and to work according to your boss’s expectations. With passive income streams, you can work whenever and however you want to work. You become your own boss.

Downsides of Job Alternatives

Even though the idea of setting up income streams sounds alluring, actually pursing them takes a lot of dedication, risk, and even luck. Indeed, there is a good chance that the plan will not be lucrative in the end. Alternatively, it could turn out more lucrative than any job you have had.

The surest and perhaps least risky way of making an income is to get a job. With a job, you can expect a certain amount of payment in exchange for a certain number of hours a week. For the most part, it is a pretty reliable arrangement that you can count on.

On the other hand, passive income is oftentimes less consistent. It might not be until years after that you put in work that your hard work finally starts to pay off. When it does, it might be that it is many times more lucrative than any job you might have held. Sadly, there is also the chance that the passive income stream does not generate any income for quite some time and thus operates on a net loss. Because of this, it is definitely less reliable than a job.

Due to the risk involved with job alternatives, you should go into these only when you have established plans to mitigate risks. For example, you might not want to quit your job until you have established that your passive income streams are generating a consistent stream of income. Or you might want to maintain a part time job even when your passive income streams are thriving.

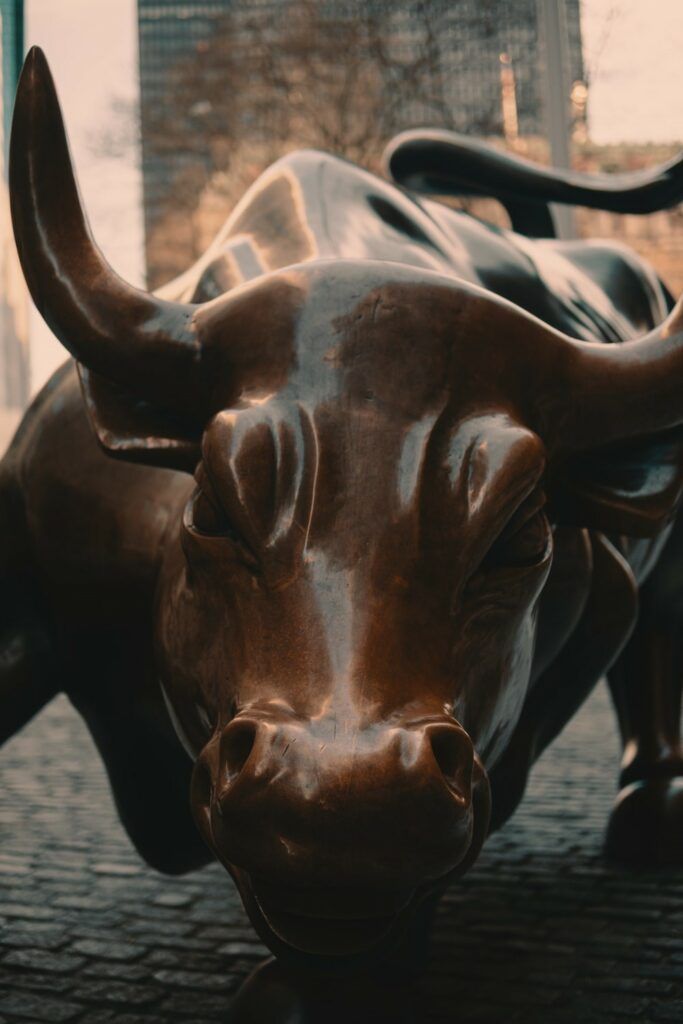

Stock Market Investing – The Easiest of Job Alternatives

It needs to be said that not all forms of passive income are the same. Some forms are less risky than others. Over the long run, the stock market, assuming you are well diversified, can serve as a pretty sure way to build passive income.

For most of its history, the stock market has been generally gone up with time. Of course, there have been periods where the stock market has dropped. But with time it has consistently recovered. Sure, individual stocks might have failed. However, as a whole, the stock market has gone up over its history. Thus, if you invest, be sure to be well diversified. Otherwise, investing in the stock market could be considered the same as gambling.

If done correctly, investing in the stock market is a good idea as not a lot of time commitment is required to invest in the stock market. With today’s technology, it is a breeze to create a brokerage account and invest in one or several index funds. Furthermore, there are brokers nowadays that have no commissions for investing. Investing with such ease and at such a bargain was not something that existed many years ago and that may not exist in other parts of the world.

You should definitely take the time to learn about and start investing as soon as you can. After all, participating in the stock market is one of those things that the longer you are able to participate, the better your returns will be over time. It might seem intimidating at first but is easy once you get the hang of it. Start with small amounts and increase as you become more comfortable.

Start a Business – Second Best Job of Alternatives

Staring your own business is another undertaking that can potentially generate passive income. However, in order for it to be a possibility, you need to you need to be able to set up your business in a manner that you can detach how much income you make with how much and when you work. Fortunately, this is possible by creating certain types of online businesses.

Specifically, Start an Online Business

Online businesses are generally the best way to build a passive income business, in my opinion. With the digital age, the cost of starting an online business can be relatively low. You might need to invest in the cost of the webpage. If you need help getting started, you might also want to invest in a Premium Wealthy Affiliate subscription, for about a dollar a day. This membership will provide you with resources and network of individuals to help you create a successful business.

The investments that you might make to start an online business are minimal compared to the large capital that would otherwise be needed to start a brick-and-mortar business that sales physical products. Of course, your online business will likely not a reliable source of income at first. You will need to put in a lot of time and energy before you see any results. If you focus your business only on things that you enjoy, you will probably enjoy the process. But if things don’t work out, at least you did not lose immense capital and spent your time doing something you enjoyed.

At first, you might want to handle everything related to yourself online business to minimize the costs. However, as your business becomes successful, you can pay others to take over some of this work. This way you can expand your business and further free up your own time. In essence, your business would become even more passive than it once was. However, you should still remain attentive to your business to ensure that it is working as you envision.

Invest in Real Estate (After You Have a Strong Economic Foundation)

Real estate investing is not an option I have personally explored but I feel as I need to mention it because so many people tout it as a great way to generate passive income. I am not a fan of real estate investing because it requires you to tie a sizeable portion of your assets into property. In fact, investing in real estate might require you to get into debt as you might not be able to find a property that you can afford to pay in full. After all, you would probably want to buy a property in decent shape as a run-down might turn out even more expensive after factoring rehabilitation expenses.

If you are just starting out building wealth, this is a risky thing to take on, in my opinion. There are so many things that can go wrong. The property might depreciate. And if your goal is to rent it, you might get tenants that destroy your property or don’t pay their rent. Also, as a landlord, you will also be responsible to do certain amount of upkeep on the property.

You might be Interested in: Why Not to Invest in Real Estate

Despite my weariness of real estate investing, I do think it can a good way to diversify your passive income streams after you have already established yourself financially and could potentially withstand losses. Assuming most people looking for alternatives to a job do not yet have the financial freedom to take on such risks, I am wary of suggesting that real estate is the first type of passive investment stream you should pursue.

Conclusion

Society instills in us the necessity to maintain a job to earn income. Unfortunately, a lot of people do not like their job, their work environment, or their boss. Some simply wish they could work less hours at their job to pursue other things they also enjoy. Or they might wish to take some time, perhaps some years, off from work to do a lot of reading and personal exploration. After all, out time on earth is limited and it would be nice to spend more of it doing things we enjoy.

While holding a job may be the only way to secure our comfortable survival, there are alternative ways of making money that don’t involve working a traditional job. These are things that you should explore while holding a job. The key to doing this is to start developing passive income streams that will create money for you in a manner that is not dependent on you work on a set schedule each day.

Passive income streams take a long time to set up. First of all, you will need to do a lot of learning and slowly put it into practice. You will probably need to invest a lot of work before you start seeing any benefits. Of course, there are some risks involved. But there are ways that you can minimize these risks.

Make a decision today to start creating passive streams of incomes that may serve as alternative to holding a job. The earlier you start taking action, the sooner you can pave your way to financial independence. You will learn a lot along the way and will hopefully enjoy the journey.